To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

The Home Guarantee Scheme, which comprises the Family Home Guarantee, the First Home Loan Deposit Scheme and the New Home Guarantee, has seen 52,888 Australians either purchase a home or reserve a place in one of the programs since 1 January last year.

A further 10,000 additional places were made available across each of the three schemes from July, with 12,251 of those since being taken.

The Family Home Guarantee, which commenced from July, has allowed single parents to purchase a home with a deposit as small as 2 per cent.

It saw 1,246 people take places in the first three months.

Assistant Treasurer and Minister for Housing Michael Sukkar reported 84 per cent of the family guarantee users were single mums.

“The government’s Home Guarantee Scheme helps overcome the challenges of saving for a deposit and has played a huge part in opening up the housing market to even more Australians,” Mr Sukkar said.

Meanwhile, the First Home Loan Deposit Scheme, which kicked off in January last year and the New Home Guarantee, which started in October 2020, are designed to support first home buyers to purchase a home with a deposit of as little as 5 per cent.

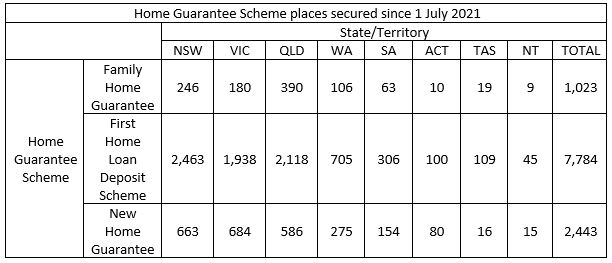

New government data has indicated intended purchase locations, showing the number of guarantees secured in each state and territory since 1 July:

Applicants do not need to formally indicate their purchase location until settlement.

In July, CBA estimated that its customers had bought property on average five years earlier than they would have otherwise, using the government’s home-ownership schemes.

The government also increased its property price caps across the First Home Loan Deposit Scheme and Family Home Guarantee in June, after it faced criticisms for its previous price limits.

[Related: APRA makes moves on home loan buffers]