To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

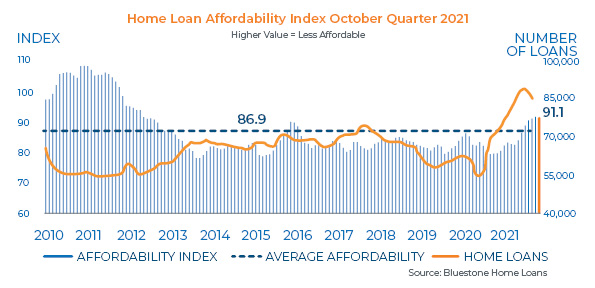

Bluestone Home Loans has released its Home Loan Affordability Index for the October quarter, revealing that while affordability remains elevated on historic levels, it has improved for the first time this year.

According to the index, which measures the proportion of the average income required for the average home loan repayment (and is derived from Australian Bureau of Statistics (ABS) data), there was a 0.4 per cent improvement in affordability in the three months to October 2021.

The previous quarter had seen affordability decline by 1.0 per cent.

Overall, the index fell to 91.1 in the October quarter. While this is an improvement from the 91.8 peak in the September quarter, it is still higher than the 90.8 recorded in the August quarter and above the long-term average of 86.9.

Indeed, Bluestone outlined that the affordability of mortgages across Australia has fallen by 14.3 per cent over the past 12 months, as house prices escalated rapidly, increasing the average loan size required by buyers.

Affordability in the NT improved the most in the October quarter, according to the index, at 0.8 per cent. The Territory continues to show the best affordability of all states and territories, having seen affordability decrease by just 4.6 per cent on an annual basis.

Victoria, NSW and ACT all saw a 0.4 per cent improvements in affordability over the October quarter, with the rate of decline in Queensland also easing.

However, NSW, Victoria and Tasmania continue to report the sharpest declines in affordability over the past year.

NSW is the least affordable state for home loans, being 18.5 per cent less affordable than it was in the October quarter 2020, and 28.1 per cent higher than the national result (measured as a 100 base over the October quarter).

Dr Andrew Wilson, consultant economist for Bluestone Home Loans, commented: “Although the easing of recent severe COVID lockdown restrictions reactivated impeded home buyers, the cyclical cooling of housing markets, particularly in Sydney and Melbourne, will likely result in lower home lending activity overall – and well below the levels at the peak of the home loan boom earlier in 2021.

“Short-term sharp shifts in migration have implications for housing markets with significant changes in demand impacting rents and prices.

"Opening borders and a rapid reintroduction of mass international migration (notwithstanding further COVID outbreaks) will however provide a significant demand source that will act to reinvigorate housing markets generally over the medium-term.”

[Related: FHB affordability dire in Tasmania: NHFIC]