The COVID-19 pandemic is providing many challenges for lenders and credit providers. One that many were unprepared for is the rapid increase in hardship claims being made by both consumers and businesses as the social and economic impact of the pandemic takes hold.

With latest reports confirming that more than half a million Australians have already applied for hardship relief, and some lenders already receiving negative press on their treatment of hardship customers, credit providers now face the critical task of ensuring each customer is supported and guided through their individual hardship journey.

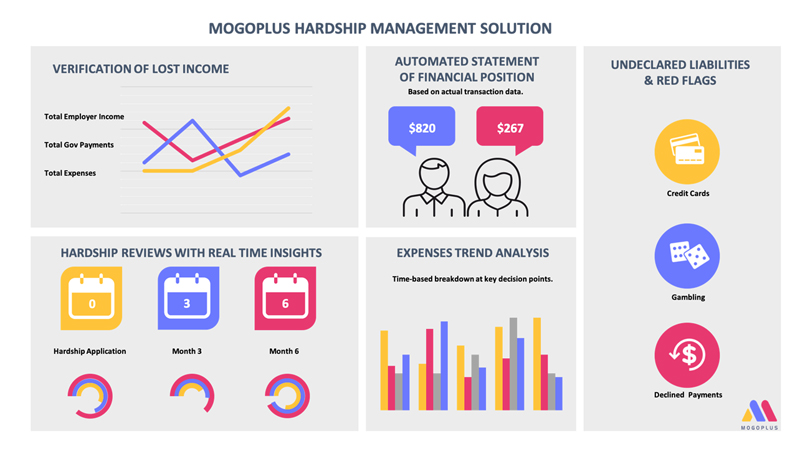

Confirming lost income, verifying new Government support payments and analysing changes in fixed and variable expenses will be important factors in helping customers get back on their feet and avoid further slippage into damaging default situations.

To assist in this challenge, MOGOPLUS has launched their Hardship Management Solution, a new set of transactional data analytics designed specifically for lenders to manage hardship journeys.

How does it work?

The solution utilises customer transaction data to instantly produce a range of key insights and hardship ‘flags’ related to the hardship situation. It enables Customer support teams to view and track movements in income, expenses and liabilities both when hardship is requested and at regular stages throughout the hardship journey including formal 3 and 6 month review points.

The analytics also provide early indicators and transactional ‘triggers’ where vulnerable customers may be trending towards potential hardship so a highly pro-active prevention based position can be taken by the lender.

What analytics are available?

Example hardship analytics include:

- An automated and instant Statement of Financial Position

- Validation of lost income and new Government payments

- Detailed breakdown of expenses with full trend analysis at set points during the hardship journey

- Identification of additional undeclared income sources and liabilities

Mike Page, MOGOPLUS Country Manager for Australia and NZ commented. “Traditional hardship is often a ‘set and forget’ process with limited pro-active engagement from the credit provider to monitor transactional behaviour and prevent hardship escalating to default. With the use of real time data and our ability to structure it into meaningful hardship insights, we can now enable a new approach which reduces operational cost for the lender whilst also presenting opportunities for increased levels of customer experience and engagement.”

Why is it different?

By using real time transactional data within the hardship journey, the credit provider can develop a personalised hardship program and future payment plan for each individual customer. This can be based on their unique circumstances, level of affordability and changing financial position.

The solution adheres to the key elements of the ABA’s Financial Hardship Guidelines and Principles and is fully supported by MOGO’s PCI-DSS attestation and comprehensive data security architecture, so all sensitive data is protected at the highest level.

Is it easy to use?

With a modular approach, the solution can be set up and operational within a day with no integration required. The analytics engine is also fully integrated into a number of existing end-to-end collections and receivables platforms with some of MOGO’s industry partners.

“As well as managing existing application workloads, banks, credit unions and non-bank lenders are also telling us they are anticipating further challenges when hardship plans need to be reviewed after 3 months, which in many cases will be in July”. Page comments. “With the ability to accurately and instantly analyse recent income and expense trends at this point, hardship triage processes can be managed more efficiently putting less strain on operational teams and providing positive customer experiences.”

Early discussions with the lending community have been overwhelming and the solution is already being integrated into a number of hardship workflows.

As part of the MOGOPLUS COVID-19 Industry Support Initiative, and to assist lenders and credit providers in this challenging period, MOGOPLUS is making the solution available for free for any lender to use for the first 60 days

Further information on the Hardship solution via the MOGOPLUS website www.mogoplus.com or by emailing

About MOGOPLUS

MOGOPLUS provides Data, Analytics and Responsible Lending solutions to enable credit providers to make more informed decisions in real time. We operate in the Australian and UK markets with a customer base covering Tier 1 banks, Neo (digital only) banks, Non-bank lenders and credit service providers across home loans, personal loans and credit cards