To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

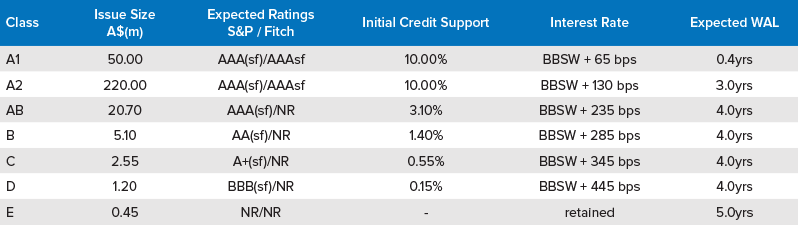

The AFG 2016-1 Trust RMBS transaction is the Australian Finance Group's (AFG) first issuance since 2014, and is broken into seven tranches, ranging from $220 million to $450,000 in size.

The transaction, which was arranged by National Australia Bank Limited (NAB) with joint lead managers from ANZ and NAB, will settle on November 4.

AFG chief operating officer David Bailey said the securitisation program is an important contributor to the company’s overall growth strategy.

He said: “To execute a transaction under the terms achieved, in a market which has been relatively volatile in 2016, is very pleasing. The other positive aspect was that we were able to welcome some new investors to our programme.

“The success of [this] issue reflects the confidence of domestic and offshore investors in the high-quality lending standards that AFG Securities apply.”

Adding that a “strong RMBS market it vital to ensure a greater level of competition and choice into the Australian mortgage market”, Mr Bailey concluded: “The performance of any mortgage starts and ends with the credit policies and appetite of the lender. Our AFG Securities programme has consistently delivered a strong performance and it is this performance which has helped underpin the success of our latest transaction.”

[Related: Major aggregator posts strong growth amid market headwinds]