To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

New research from National Australia Bank (NAB) has shown that Australians generally feel that they are coping well with their finances, the proportion of borrowers who said they are experiencing financial hardship has increased.

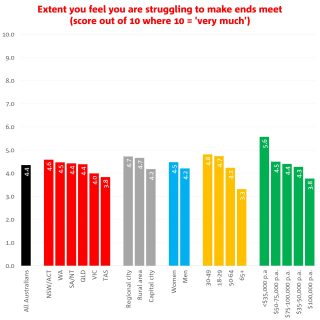

The research on financial health, which was conducted by NAB Economics between 18-26 May and was based on the survey responses from 2,050 Australians (weighted to the population), found that Australians scored their financial health 4.4 out of 10 (with 10 signaling the highest level of struggle).

However, 35 per cent of Australians said they experienced financial hardship over the last three months, up from a survey low of 29 per cent in Q1, March, April and May.

Half of those on low-incomes said they faced some form of financial hardship over the past three months.

People on low incomes (around $35,000 per annum) reported that they didn’t have enough for emergencies (31 per cent), food and necessities (26 per cent) or were unable to pay healthcare and medical bills (16 per cent).

Australians living in regional cities and rural areas were also found to be feeling more financial challenges when compared to their capital city counterparts, with regional and rural residents both scoring 4.7 points out of 10, while capital city residents scored a 4.2.

The largest number of people saying there were struggling ‘very much’ were in Western Australia (WA), with the smallest in South Australia/Northern Territory and Tasmania (15 per cent).

Women were also more likely to say they were under pressure than men (19 per cent, compared to 16 per cent).

Those experiencing financial pressures have reportedly used credit cards more often, and turned to friends and family to borrow money, while one in 10 turned to a payday lender, NAB found.

Speaking of the data, NAB group executive personal banking, Rachel Slade, said even though most customers are in good financial positions, there are still some pockets of concern.

“70% of NAB customers are ahead on their home loan payments but we do know there are some people who are feeling the pressure of an increased cost of living,” Ms Slade said.

“This research brings to life exactly the concerns customers are raising with our NAB Assist team,” Ms Slade said.

According to Ms Slade, the survey of 2,050 Australians revealed that financial hardship can present itself in a range of ways.

“Finding yourself in financial difficulty can mean being unable to pay a bill, cover rent on time, meet minimum credit card payments or being unable to take care of medical expenses.

“Regardless of what challenges you are coming up against, if you are feeling financial pressure, we want to talk with you,” Ms Slade said, urging those who feel financial pressure to contact the lender for assistance.

The data comes after research from the Australian Bureau of Statistics (ABS) found that mortgages in Australia, alongside the cost of living, have increased over the last three months as prices and interest rates escalate.

As highlighted in the latest Selected Living Cost Index data from the ABS, there was a complete rise across all five measured groups during the June quarter, with mortgage costs also lifting over the same period.

The index, which measures the price change of goods and services alongside its effect on living expenses, explored five specific cohorts: pensioners and beneficiaries, employees, age pensioners, other government transfer recipients, and self-funded retirees.

According to the index numbers, self-funded retirees had the biggest index number for the June quarter in regard to mortgage interest charges, lifting from a score of 56.8 to 58.2 over the three-month period.

This was followed by employee households, which grew by 1.4 points to reach 57.4.

[RELATED: NAB reports lift to lending, deposits following Citi acquisition]