To continue reading the rest of this article, please log in.

Create free account to get unlimited news articles and more!

In a speech to the AFR Banking & Wealth Summit in Sydney yesterday, APRA chairman Wayne Byres said that stronger regulation introduced after the GFC has not had a negative impact on bank lending.

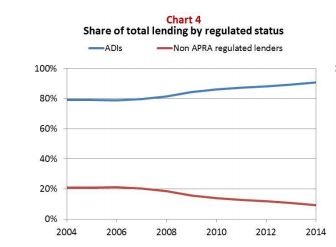

Mr Byres noted the proportion of total credit provided by regulated and unregulated institutions, remarking that the chart (below) indicates a steady increase in the proportion of credit provided by regulated institutions.

“Whether that is a good thing I will leave for others to judge, but it certainly does not lead one to conclude that the stronger regulation introduced in the post-crisis period has adversely impacted the ability of regulated institutions to provide credit vis-à-vis that of their unregulated counterparts,” he said.

“Indeed, if anything, it supports the argument that we have often made: that strong financial institutions make strong competitors, and in the post-crisis world the virtues of financial strength and regulated status are likely to be of greater value than was the case previously.”

However, the chart clearly shows a decline in non-bank lending since the GFC, with non-bank market share falling from 20 per cent in 2007 to 10 per cent in 2014.

APRA's comments come a day after FSI chair David Murray voiced his concern over unregulated lenders.

“The intent of some of our [FSI] recommendations was to create a regulatory environment where it is watched,” he said.

Mr Murray gave the example of Woolworths as a large non-traditional, non-bank player with the potential to significantly disrupt the Australian lending landscape.

“They have positive working capital and they can start financing the supply chain all day without being a bank,” he said.

“It doesn’t take too much imagination to figure out how you get around this if the regulators get over the top. We have to watch out.”

Speaking at the AFR Summit on Tuesday, CBA chief executive Ian Narev said the growing number of new banking entrants should be subject to the same regulations to protect customers.